New article from Tatton Investment Management: Goodbye 2019 - welcome 2020 and a new decade!

23 December 2019, 12:00am

The fourth quarter of 2019 has felt like a mirror-image of 4Q 2018. Liquidity was tight then, and is abundant now, particularly since the US central bankers restarted their purchases of US government bonds. Previous rounds of quantitative easing (QE) were aimed at bringing down longer term lending rates to stimulate the economy. But this time the Federal Reserve is buying assets in order to ease strains in New York’s short-term interbank lending markets. This may be an important point of principle for economists. However, it appears to make no difference to stock markets: they have rallied over the quarter as any fears of credit market stresses have receded further, even though the causes of such stress from a slowing economy have arguably increased.

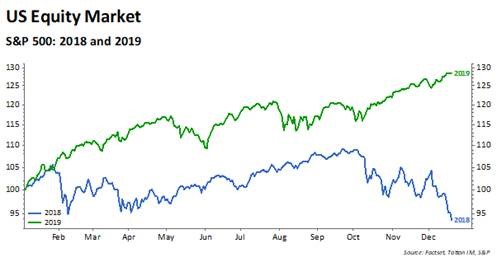

The economy was strong 12 months ago but seemed to be weakening. Now, decidedly weak it looks to be strengthening for the coming quarters. Markets (especially the US equity markets) have behaved in the reverse way, as the chart below shows.

The start of 2019 saw a reversal of the market rout at the end of 2018, as it became clear the Fed was reversing course.

This time around, we do not think the Fed will reverse its liquidity injections meaningfully but there may be less headroom if further monetary stimulus was called for in face of a deteriorating environment. Meanwhile, expectations of an economic rebound could take some time. The release of Q4 2019 earnings during January will be watched closely for directional signals, but are likely to be underwhelming, showing no – or even negative – growth. That will stretch valuations in US markets further at a time when they are already trading at the very lofty heights of almost 19 times annual earnings. The last time we reached those levels was in January 2018, when they were accompanied by talk of ‘irrational exuberance’ and were corrected downwards considerably over the further course of 2018.

This will make markets nervous, but the notable difference between then and now is the most likely direction of travel of the global economy. Back then, it was feared to be coming off a synchronous high. Now, there is every expectation that it is improving from a synchronous low in growth rates. The evidence for this actually happening imminently is still feeble, with the strongest evidence of a turnaround once again – and somewhat surprisingly - coming from China, while the data flow from Europe, the US and Japan can at best be described as mixed.

Still, if there is a dip, many investors who have missed this quarter’s rally will be itching to buy at lower prices. The real danger is if there is a shock, and the most likely source remains US-China trade negotiations. These are on-going, and phase 1 was a very small win for the two sides. The rhetoric got a little more confrontational again this week, and phase 2 game playing is just starting. 2020 will be interesting.

2010/2020 - a decade back, one forward - Endings and Beginnings

Another day, another decade. As we come to the end of the only decade that is so far without a catchy nickname (how about ‘the Teenies’ to follow the Noughties’ of 2000-2009?), we thought it appropriate to look back at the themes and events that shaped the last 10 years – and dare to look forward to what might shape the next.

Looking Back

The 2010s started with diverging opinions on what was in store. In economic and financial terms, the 2000s ended about as badly as they could have. But after the horror years of 2008 and early 2009, initially it seemed as though the global financial crisis and ensuing great recession would prove to be just another short – even if very severe – recessionary blip after which things would return to the previous ‘normal’. By the start of the decade, asset values had mostly recovered, banks had recapitalised, the financial system no longer seemed dysfunctional, and the global economy had staged a remarkable growth recovery. Optimists (some on our own team) thought this rekindled stability would underly a return to strong global growth and put the nightmare behind us.

Pessimists disagreed, suggesting that the ghost of crises past would stay with us, ushering in a ‘lost decade’ of Japan-style stagnation. In a way, they were right. The extraordinary monetary stimulus from central banks managed to avoid a repeat of a disastrous 1930s-style depression, but over a decade since the crash, those ‘short-term’ crisis measures are still with us. Historically low interest rates, massive central bank asset purchase programs, and – crucially – sluggish economic growth have been the hallmarks of the last decade.

In the financial world, monetary policy has taken centre stage unlike ever before. Central bank guidance and policy meetings (such as the annual Jackson Hole conference) have become the centres of attention for global investors. Few could argue that support was needed to bolster the return of confidence in the financial system, but the trillions of dollars of liquidity provided by central banks have undoubtedly had a distorting effect on capital markets. Bond yields have sunk and remain below 0% for vast amounts of public debt, and elsewhere at least only around the rate of inflation. Volatility has been crushed and asset prices have become highly correlated, regardless of the quality and likely sustainability of their underlying profit streams.

Such long exposure to monetary intensive care – like any strong medication without sufficient rehabilitation measures – has had some uncomfortable side effects. If the rising tide lifts all boats, it does not matter which one you are on, and so high asset correlation prompted an exodus from active fund management into passive index-tracking funds. However, the lack of dispersion and the dropping away of active fund managers has meant that, when the market mood turns sour, there is no one to step in – leading to sharper price falls than we would have expected under similar circumstances in the past (as we saw at the end of 2018 and the beginning of 2016).

Sinking returns on ‘risk-free’ assets caused money that would otherwise have been seeking less risky sources of positive returns to pile into speculative investment opportunities – creating cohorts of ‘reluctant investors’ who are much more prone to ‘crashing out’ again at the slightest hint of a market turn. The commodities bubble in 2014 was a prime example. ‘Reluctant investors’ were seeking investment returns in what they perceived as an asset class untainted by the aftermath of the financial crisis, but independently driven by the relentless catch-up in growth and natural resources demand of the world of emerging economies.

The unwinding effects of these false price signals to the resource industry became a key theme of the middle part of the decade as they caused the first mid-cycle slowdown in the demand for manufactured goods. Booming property prices, despite stagnant fundamentals (i.e. low wage growth), was another. Amidst investor resignation that low growth will be the norm we have seen high-growth technology stocks become the only game in town, leading to some extreme equity valuations as any form of meaningful growth becomes addictively attractive.

Financial distortion has also created economic distortion. Central bank policy has underpinned a broad-based and substantial recovery in asset prices – to the benefit of asset-holders. Meanwhile, wage growth has stagnated in the developed world, leading to a significant increase in actual as well as perceived wealth inequality. Those without prior capital stock – typically the young and/or low earners – have seen low or non-existent growth in living standards, while the older and better off have enjoyed some of the best returns in recent memory. This created populism amongst the not capital rich disenfranchised and subsequent geopolitical destabilisation in a way not seen since the 1930s. Accelerating climate change and loss of economic perspective motivated the younger generation and created fractions across western societies, with many worried about the longer-term consequences.

What caused that wage stagnation? .....

News Archive

27 June 2025, 05:00pm

Latest news from Tatton Investment Management: Markets recalibrate to Trump 2.0

20 June 2025, 05:00pm

Latest news from Tatton Investment Management: The risks are real – but priced in

13 June 2025, 05:00pm

Latest news from Tatton Investment Management: Calm but not comfortable

6 June 2025, 05:00pm

Latest news from Tatton Investment Management: Summer starts with less spring

30 May 2025, 05:00pm

Latest news from Tatton Investment Management: Complacency or checks and balances?

23 May 2025, 04:00pm

Latest news from Tatton Investment Management: Return of the Bond Vigilantes

16 May 2025, 12:00am

Latest news from Tatton Investment Management: A rally that requires belief

9 May 2025, 04:00pm

Latest news from Tatton Investment Management: Markets calm but trouble still bubbles

2 May 2025, 05:00pm

Latest news from Tatton Investment Management: Markets cheer US policy stabilisation

25 April 2025, 04:00pm

Latest news from Tatton Investment Management: Improving mood versus slowing growth

17 April 2025, 05:00pm

Latest news from Tatton Investment Management: Volatility drops but uncertainty remains

11 April 2025, 05:00pm

Latest news from Tatton Investment Management: Ceasefire, not truce, in global trade war

8 April 2025, 05:00pm

Latest news from Tatton Investment Management: Market update, or staying calm in a crisis

4 April 2025, 05:00pm

Latest news from Tatton Investment Management: Trump’s Liberation Day turns into market clear out

28 March 2025, 05:00pm

Latest news from Tatton Investment Management: Tariff ‘stick’ to be followed by ‘fiscal’ carrot?;

21 March 2025, 05:00pm

Latest news from Tatton Investment Management: Bracing for tariff “Liberation Day”

14 March 2025, 05:00pm

Latest news from Tatton Investment Management: Just another growth scare, or more?

7 March 2025, 12:00am

Latest news from Tatton Investment Management: The return of regional divergence

28 February 2025, 05:00pm

Latest news from Tatton Investment Management: Honeymoon ends early

21 February 2025, 05:00pm

Latest news from Tatton Investment Management: Global politics turn business

14 February 2025, 05:00pm

Latest news from Tatton Investment Management: Europe First?

7 February 2025, 05:00pm

Latest news from Tatton Investment Management: Up and down and on and off

31 January 2025, 05:00pm

Latest news from Tatton Investment Management: AI upset challenges market status quo

24 January 2025, 05:00pm

Latest news from Tatton Investment Management: Trump trade still on?

17 January 2025, 05:00pm

Latest news from Tatton Investment Management: Calmer markets ahead of Trump inauguration

10 January 2025, 05:00pm

Latest news from Tatton Investment Management: UK bond yield surge – more than meets the eye

3 January 2025, 05:00pm

Latest news from Tatton Investment Management: Happy New Year!

20 December 2024, 05:00pm

Latest news from Tatton Investment Management: Fed spoils the Christmas party

13 December 2024, 05:00pm

Latest news from Tatton Investment Management: Don’t fear the rebalance

6 December 2024, 05:00pm

Latest news from Tatton Investment Management: Focus turns to Europe

29 November 2024, 05:00pm

Latest news from Tatton Investment Management: Equities and bonds go separate ways

22 November 2024, 05:00pm

Latest news from Tatton Investment Management: More and more loose ends

15 November 2024, 05:00pm

Latest news from Tatton Investment Management: Reading Trump’s tea leaves

8 November 2024, 05:00pm

Latest news from Tatton Investment Management: Known winner, unknown outcomes

1 November 2024, 05:00pm

Latest news from Tatton Investment Management: US, not UK battening down the hatches

25 October 2024, 05:00pm

Latest news from Tatton Investment Management: Markets in brace position

18 October 2024, 05:00pm

Latest news from Tatton Investment Management: Focus returns to stock market fundamentals

11 October 2024, 05:00pm

Latest news from Tatton Investment Management: Buy the rumour, sell the fact

4 October 2024, 12:00am

Latest news from Tatton Investment Management: Why are markets so calm?

27 September 2024, 05:00pm

Latest news from Tatton Investment Management: Global growth tailwinds

20 September 2024, 05:00pm

Latest news from Tatton Investment Management: Central bank Pivot 2.0

13 September 2024, 04:00pm

Latest news from Tatton Investment Management: Market fears fading

5 September 2024, 12:00am

Latest news from Tatton Investment Management: Nervous markets ahead of second pivot

30 August 2024, 05:00pm

Latest news from Tatton Investment Management: Balancing acts

23 August 2024, 05:00pm

Latest news from Tatton Investment Management: Late Summer heatwave

16 August 2024, 05:00pm

Latest news from Tatton Investment Management: Tornado rather than hurricane

9 August 2024, 05:00pm

Latest news from Tatton Investment Management: Market correction turns into pothole

2 August 2024, 05:00pm

Latest news from Tatton Investment Management: Central bank week

26 July 2024, 05:00pm

Latest news from Tatton Investment Management: Don’t fear the rebalance

19 July 2024, 05:00pm

Latest news from Tatton Investment Management: Shock, rotation, growth?

12 July 2024, 04:00pm

Latest news from Tatton Investment Management: Lower inflation, less profits?

5 July 2024, 05:00pm

Latest news from Tatton Investment Management: New government, same economy

21 June 2024, 04:30pm

Latest news from Tatton Investment Management: Stock market highs don’t feel so high

14 June 2024, 05:00pm

Latest news from Tatton Investment Management: Still mostly sticking to the plan

7 June 2024, 05:00pm

Latest news from Tatton Investment Management: ECB’s Lagard makes rate cut history

31 May 2024, 05:00pm

Latest news from Tatton Investment Management: Markets consolidate

24 May 2024, 04:00pm

Latest news from Tatton Investment Management: Nvidia versus the Fed

17 May 2024, 05:00pm

latest news from Tatton Investment Management: Pluses and minuses

10 May 2024, 05:00pm

latest news from Tatton Investment Management: A blooming May for the UK

3 May 2024, 05:00pm

latest news from Tatton Investment Management: Still sticking to the plan

26 April 2024, 05:00pm

latest news from Tatton Investment Management: Inflation, a common side effect of growth

19 April 2024, 12:00am

latest news from Tatton Investment Management: Market quiet on the Middle Eastern front

12 April 2024, 05:00pm

latest news from Tatton Investment Management: What the return of volatility tells us

5 April 2024, 05:00pm

latest news from Tatton Investment Management: Bumpy start to the quarter

29 March 2024, 05:00pm

latest news from Tatton Investment Management: Everyone is an optimist now

22 March 2024, 05:00pm

latest news from Tatton Investment Management: Stick to the plan

15 March 2024, 05:00pm

latest news from Tatton Investment Management: The flipside of inflation - growth

8 March 2024, 05:00pm

latest news from Tatton Investment Management: At least currency markets noticed the budget

1 March 2024, 12:00am

Latest news from Tatton Investment Management: Winners and losers of stabilising yields

23 February 2024, 05:00pm

Latest news from Tatton Investment Management: M&A activity sets growth against value

16 February 2024, 12:00am

Latest news from Tatton Investment Management: UK not growing really, not growing nominally

9 February 2024, 05:00pm

Latest news from Tatton Investment Management: US stock market entering bubble territory?

2 February 2024, 05:00pm

Latest news from Tatton Investment Management: Central banks challenge Goldilocks assumptions

26 January 2024, 05:00pm

Latest news from Tatton Investment Management: Positive growth sentiment returns

19 January 2024, 05:00pm

Latest news from Tatton Investment Management: Data versus Davos

12 January 2024, 05:00pm

Latest news from Tatton Investment Management: A bumpy upwards path ahead

5 January 2024, 04:40pm

Latest news from Tatton Investment Management: After the party, the hangover?

15 December 2023, 05:00pm

Latest news from Tatton Investment Management: Central bank elves boost 2023 Santa rally

8 December 2023, 05:00pm

Latest news from Tatton Investment Management: A bit of a downer

1 December 2023, 12:00am

Latest news from Tatton Investment Management: Price shock reversal

24 November 2023, 12:00am

Latest News from Tatton Investment Management: Thanksgiving lull

17 November 2023, 05:00pm

Latest News from Tatton Investment Management: Inflation genie back in the bottle?

10 November 2023, 04:00pm

Latest News from Tatton Investment Management: Back pedalling central bankers

3 November 2023, 12:00am

Latest News from Tatton Investment Management: Dovishness proves contagious

27 October 2023, 05:00pm

Latest News from Tatton Investment Management: The resilience narrative comes under pressure

20 October 2023, 05:00pm

Latest News from Tatton Investment Management: Bond yield volatility has markets guessing

13 October 2023, 05:00pm

Latest News from Tatton Investment Management: Capital markets and war

9 October 2023, 09:00am

Latest News from Tatton Investment Management: Recession fears creeping back

2 October 2023, 09:00am

Latest News from Tatton Investment Management: Economic resilience is about to be tested

22 September 2023, 04:00pm

Latest News from Tatton Investment Management: To yield or not to yield

15 September 2023, 05:00pm

Latest News from Tatton Investment Management: Central bank hawks determined to defang inflation

8 September 2023, 05:00pm

Latest News from Tatton Investment Management: Energy in focus - oil prices up and an ill wind for r

1 September 2023, 12:00am

Latest News from Tatton Investment Management: New school term has the US back at the top

25 August 2023, 12:00am

Latest News from Tatton Investment Management: Bonds still calling the shots

18 August 2023, 05:00pm

Latest News from Tatton Investment Management: Bonds are back

11 August 2023, 05:00pm

Latest News from Tatton Investment Management: Summer markets

4 August 2023, 12:00am

Latest News from Tatton Investment Management: Weather matters

28 July 2023, 05:00pm

Latest News from Tatton Investment Management: Rate rises bouncing off 'Teflon' markets

21 July 2023, 05:00pm

Latest News from Tatton Investment Management: Another inflation driver turns over

14 July 2023, 05:00pm

Latest News from Tatton Investment Management: Core inflation slowdown equals an upbeat week for equ

7 July 2023, 05:00pm

Latest News from Tatton Investment Management: Markets sour on news of resilient economy

30 June 2023, 12:00am

Latest News from Tatton Investment Management: A glass half-full half year

23 June 2023, 05:00pm

Latest News from Tatton Investment Management: Markets cathcing up with reality

16 June 2023, 05:00pm

Latest News from Tatton Investment Management: Market conundrum amid volatile growth

9 June 2023, 05:00pm

Latest News from Tatton Investment Management: Immaculate disinflation sentiment cheers investors

2 June 2023, 05:00pm

Latest News from Tatton Investment Management: Markets take good news in their stride

26 May 2023, 05:00pm

Latest News from Tatton Investment Management: Debt ceiling angst or simply lack of good news

19 May 2023, 12:00am

Latest News from Tatton Investment Management:Big tech stocks increase is 'artificial'

12 May 2023, 12:00am

Latest News from Tatton Investment Management: Central bank policy gamble?

5 May 2023, 05:00pm

Latest News from Tatton Investment Management: A small predicament

28 April 2023, 05:00pm

Latest News from Tatton Investment Management: Inflation running out of money

21 April 2023, 05:00pm

Latest News from Tatton Investment Management: Prospects of a warm spring

14 April 2023, 05:00pm

Latest News from Tatton Investment Management: Return of calm bodes well for Spring

6 April 2023, 12:00am

Latest News from Tatton Investment Management: Spring of hope following winter of doom?

31 March 2023, 12:00am

Latest News from Tatton Investment Management: Markets put bank stress behind, but challenges remain

24 March 2023, 12:00am

Latest News from Tatton Investment Management: Swiss parochialism backfires

17 March 2023, 12:00am

Latest News from Tatton Investment Management: Bank stress testing - live

10 March 2023, 12:00am

Latest News from Tatton Investment Management: Market wrestling

3 March 2023, 12:00am

Latest News from Tatton Investment Management: Mood swings

24 February 2023, 12:00am

Latest News from Tatton Investment Management: Balancing acts

17 February 2023, 12:00am

Latest News from Tatton Investment Management: A dose of realism creeps in

3 February 2023, 12:00am

Latest News from Tatton Investment Management: A good month is not a strong year – but it helps

27 January 2023, 12:00am

Latest News from Tatton Investment Management: Goldilocks in the air

20 January 2023, 12:00am

Latest News from Tatton Investment Management: Slowing growth throws markets into a bind

13 January 2023, 12:00am

Latest News from Tatton Investment Management: Football fever saves UK from recession

6 January 2023, 12:00am

Latest News from Tatton Investment Management: January surprises

16 December 2022, 12:00am

Latest News from Tatton Investment Management: Central bank Scrooges cancel Santa rally

9 December 2022, 12:00am

Latest News from Tatton Investment Management: Fed up before Christmas

2 December 2022, 12:00am

Latest News from Tatton Investment Management - Not so bad? Almost good

25 November 2022, 12:00am

Latest News from Tatton Investment Management: Markets give thanks

18 November 2022, 12:00am

Latest News from Tatton Investment Management: Plugging the holes

11 November 2022, 12:00am

Latest News from Tatton Investment Management: Signs of ‘peak inflation’ emboldens markets

4 November 2022, 12:00am

Latest News from Tatton Investment Management: Diverging paths accompanied by seasonally scary messa

28 October 2022, 12:00am

Latest News from Tatton Investment Management: US slows, Europe’s winter outlook improves, UK back t

21 October 2022, 12:00am

Latest News from Tatton Investment Management: The UK and beyond

14 October 2022, 12:00am

Latest News from Tatton Investment Management: Change in the air

7 October 2022, 12:00am

Latest News from Tatton Investment Management: Reading the runes of this week's market bounce

30 September 2022, 12:00am

News from Tatton Investment Management: Loss of trust

23 September 2022, 12:00am

News from Tatton Investment Management: Competing policy measures leave markets worried

16 September 2022, 12:00am

News from Tatton Investment Management: The Fed at work and China snubs Putin

2 September 2022, 12:00am

News from Tatton Investment Management: Waiting for policy action

26 August 2022, 12:00am

News from Tatton Investment Management: Delicate equilibrium

19 August 2022, 12:00am

News from Tatton Investment Management: Will a new PM be good news for investors?

12 August 2022, 12:00am

News from Tatton Investment Management: Fear of missing out

5 August 2022, 12:00am

News from Tatton Investment Management: Markets bet on a perfect landing

29 July 2022, 12:00am

News from Tatton Investment Management: Positive returns amidst negative sentiment

22 July 2022, 12:00am

News from Tatton Investment Management: Economy weakens but central banks persevere

15 July 2022, 12:00am

News from Tatton Investment Management: Too hot, too cold

8 July 2022, 12:00am

News from Tatton Investment Management: Markets not reflecting public fear

4 July 2022, 12:00am

News from Tatton Investment Management: Energy price shock turns into central bank focal point

24 June 2022, 12:00am

News from Tatton Investment Management: Public sentiment vs economic realities

17 June 2022, 12:00am

News from Tatton Investment Management: Linchpin oil price

10 June 2022, 12:00am

News from Tatton Investment Management: Reading between the lines

3 June 2022, 12:00am

News from Tatton Investment Management: Rollercoaster for the Jubilee funfair

27 May 2022, 12:00am

News from Tatton Investment Management: As recession talk subsides, inflation pressures increase

23 May 2022, 12:00am

News from Tatton Investment Management: Talking recession to fight inflation

13 May 2022, 12:00am

News from Tatton Investment Management: Bear market fear as another tech bubble deflates

9 May 2022, 12:00am

News from Tatton Investment Management: Market noise is almost deafening

29 April 2022, 12:00am

News from Tatton Investment Management: Range bound markets - despite the drama

22 April 2022, 12:00am

News from Tatton Investment Management: Finely balanced

14 April 2022, 12:00am

News from Tatton Investment Management: Easter review and outlook

8 April 2022, 12:00am

News from Tatton Investment Management: Q2 begins with QT top of the agenda

1 April 2022, 12:00am

News from Tatton Investment Management: A week of relative calm - and no April fool

25 March 2022, 12:00am

News from Tatton Investment Management: Better news is not always good news

22 March 2022, 12:00am

News from Tatton Investment Management: Changing tides

11 March 2022, 12:00am

News from Tatton Investment Management: Positioning for the energy price shock

4 March 2022, 12:00am

News from Tatton Investment Management: A double edged sword

25 February 2022, 12:00am

News from Tatton Investment Management: Back to the past

18 February 2022, 12:00am

News from Tatton Investment Management: Investors anxious for storms to blow over

11 February 2022, 12:00am

News from Tatton Investment Management: Investment climate change

4 February 2022, 12:00am

News from Tatton Investment Management: The Lagarde pivot hits insecure markets

28 January 2022, 12:00am

News from Tatton Investment Management: Taper Tantrum 2.0 fears rattle markets

21 January 2022, 12:00am

News from Tatton Investment Management: A bumpy road to somewhere

14 January 2022, 12:00am

News from Tatton Investment Management: Markets caught between hoping and dreading

10 January 2022, 12:00am

20 December 2021, 12:00am

News from Tatton Investment Management: Christmas tidings of comfort, if not joy

10 December 2021, 12:00am

News from Tatton Investment Management: Plan B or not Plan B? That is the question

3 December 2021, 12:00am

News from Tatton Investment Management: The pre-Christmas ‘quiz’ that not many want to play

29 November 2021, 12:00am

News from Tatton Investment Management: New COVID variant flattens 'Black Friday' feeling

19 November 2021, 12:00am

News from Tatton Investment Management: Dollar strength and divergence caps a dull week for investor

12 November 2021, 12:00am

News from Tatton Investment Management: Central banks struggle with messaging

5 November 2021, 12:00am

News from Tatton Investment Management: No tantrum over this taper

29 October 2021, 12:00am

News from Tatton Investment Management: Bond markets give central bankers a telling off

22 October 2021, 12:00am

News from Tatton Investment Management: Confused or determined central bankers?

18 October 2021, 12:00am

News from Tatton Investment Management: Have we passed the peak of supply disruption?

8 October 2021, 12:00am

News from Tatton Investment Management: Economy hits an air pocket

1 October 2021, 12:00am

News from Tatton Investment Management: Rising yields are back

24 September 2021, 12:00am

News from Tatton Investment Management: Wall of worry time

17 September 2021, 12:00am

News from Tatton Investment Management: End of the re-opening honeymoon

10 September 2021, 12:00am

News from Tatton Investment Management: Paying for it - major economies ponder their balance sheets

3 September 2021, 12:00am

New article from Tatton Investment Management: Politics and policy sit at the head of the table

27 August 2021, 12:00am

New article from Tatton Investment Management: Fed tapering: the 'how' matters more than 'when'

20 August 2021, 12:00am

New article from Tatton Investment Management: Markets hit a bit of to and fro

16 August 2021, 12:00am

New article from Tatton Investment Management: Climbing the wall of worry - again

11 August 2021, 12:00am

Midas Share Tips: The Daily Mail views onTatton Asset Management

6 August 2021, 12:00am

New article from Tatton Investment Management: Mega techs under the cosh

30 July 2021, 12:00am

New article from Tatton Investment Management: Summer lull as markets go through the motions

23 July 2021, 12:00am

New article from Tatton Investment Management: Markets wake up to living with the virus

16 July 2021, 12:00am

New article from Tatton Investment Management: Earnings vs Delta

12 July 2021, 12:00am

New article from Tatton Investment Management: Don't look down

2 July 2021, 12:00am

New article from Tatton Investment Management:Transition uncertainties

25 June 2021, 12:00am

New article from Tatton Investment Management: Moderating expectations

18 June 2021, 12:00am

New article from Tatton Investment Management: Investors try to make sense of the Fed’s 'dot-plot'

11 June 2021, 12:00am

New article from Tatton Investment Management: Hazy as Carbis Bay

4 June 2021, 12:00am

New article from Tatton Investment Management: Going up sideways

1 June 2021, 12:00am

New article from Tatton Investment Management: Going up sideways

28 May 2021, 12:00am

New article from Tatton Investment Management: Touch of Goldilocks at the end of May

21 May 2021, 12:00am

New article from Tatton Investment Management: Market resilience in face of Bitcoin crash

14 May 2021, 12:00am

New article from Tatton Investment Management: Market vertigo galore

10 May 2021, 12:00am

New article from Tatton Investment Management: Sell in May and go away?

30 April 2021, 12:00am

New article from Tatton Investment Management: Doubling of earnings leaves markets cold

26 April 2021, 12:00am

New article from Tatton Investment Management: Doubling of earnings leaves markets cold

23 April 2021, 12:00am

New article from Tatton Investment Management: 'Risk on' pauses while the real world keeps accelerat

19 April 2021, 12:00am

New article from Tatton Investment Management: New bond news gives green light for equity investors

9 April 2021, 12:00am

New article from Tatton Investment Management: Bond markets signal economic optimism

1 April 2021, 12:00am

New article from Tatton Investment Management: The first quarter of 2021 was no April fool

26 March 2021, 12:00am

New article from Tatton Investment Management: The world is moving on from the pandemic

19 March 2021, 12:00am

New article from Tatton Investment Management: Tug of war - bonds vs. equities

12 March 2021, 12:00am

New article from Tatton Investment Management: Recalibrations

5 March 2021, 12:00am

New article from Tatton Investment Management: Stock markets find they cannot have it both ways

26 February 2021, 12:00am

New article from Tatton Investment Management: Earnings look set to stabilise wobbling markets

19 February 2021, 12:00am

New article from Tatton Investment Management: One year on - who would have thought

12 February 2021, 12:00am

New article from Tatton Investment Management: No UK double dip, but much talk of bubbles

5 February 2021, 12:00am

New article from Tatton Investment Management: Calming of nerves

1 February 2021, 12:00am

New article from Tatton Investment Management: A fraying of nerves

25 January 2021, 12:00am

New article from Tatton Investment Management: A sigh of relief

15 January 2021, 12:00am

New article from Tatton Investment Management: Fiscal turbo replaces lame duck Trump

8 January 2021, 12:00am

New article from Tatton Investment Management: End points and new beginnings

18 December 2020, 12:00am

New article from Tatton Investment Management: Goodbye to all that

14 December 2020, 12:00am

New article from Tatton Investment Management: Outlook 2021 - no deal Brexit?

4 December 2020, 12:00am

New article from Tatton Investment Management: December concerns over baubles and bubbles

27 November 2020, 12:00am

New article from Tatton Investment Management: Fiscal floundering

20 November 2020, 12:00am

New article from Tatton Investment Management: More tunnel before the light

18 November 2020, 12:00am

Interim Results For The Six Month Period Ended 30 September 2020

13 November 2020, 12:00am

New article from Tatton Investment Management: Change is in the air

6 November 2020, 12:00am

New article from Tatton Investment Management: Looking beyond the obvious

4 November 2020, 12:00am

New article from Tatton Investment Management: US Election Update

2 November 2020, 12:00am

New video from Tatton Investment Management: US election, the response to the pandemic and Brexit

30 October 2020, 12:00am

New article from Tatton Investment Management: Unsettled week ahead - or behind

26 October 2020, 12:00am

New article from Tatton Investment Management: Sunlit uplands or COVID gorge?

21 October 2020, 12:00am

New article from Tatton Investment Management: Sunlit uplands or COVID gorge?

19 October 2020, 12:00am

New article from Tatton Investment Management: Watching and waiting

12 October 2020, 12:00am

New article from Tatton Investment Management: Baffling market optimism

2 October 2020, 12:00am

New article from Tatton Investment Management: A question of time horizons

25 September 2020, 12:00am

New article from Tatton Investment Management: A recovery on hold

18 September 2020, 12:00am

New article from Tatton Investment Management: Taking a step back to look forward

14 September 2020, 12:00am

New article from Tatton Investment Management: Frictions and contradictions

7 September 2020, 12:00am

New article from Tatton Investment Management: Market dynamic of a K-shaped recovery

1 September 2020, 12:00am

New article from Tatton Investment Management: Big tech gets bigger while the Fed takes the easy opt

24 August 2020, 12:00am

New article from Tatton Investment Management: Fed leaves bond investors with that sinking feeling

17 August 2020, 12:00am

New article from Tatton Investment Management: COVID II the sequel - as scary as the original?

10 August 2020, 12:00am

New article from Tatton Investment Management: July brings consolidation

2 August 2020, 12:00am

New article from Tatton Investment Management: Sunshine and shadows

27 July 2020, 12:00am

New article from Tatton Investment Management: PPE = Politics, Pressure and Economics

20 July 2020, 12:00am

New article from Tatton Investment Management: Discomfort of disappearing safety nets

13 July 2020, 12:00am

New article from Tatton Investment Management: Fast and freewheeling

3 July 2020, 12:00am

New article from Tatton Investment Management: H1 2020 offers meaningful lessons

29 June 2020, 12:00am

New article from Tatton Investment Management: Support balances increasing strains - for how long?

22 June 2020, 12:00am

New article from Tatton Investment Management: Equity valuations follow bond valuations' lead

15 June 2020, 12:00am

New article from Tatton Investment Management: Stock markets suffer altitude sickness

8 June 2020, 12:00am

New article from Tatton Investment Management: Markets are enjoying an uncomfortably benign pandemic

1 June 2020, 12:00am

New article from Tatton Investment Management: Optimistic markets despite second wave lockdown threa

26 May 2020, 12:00am

New article from Tatton Investment Management: Just as the sun comes out, clouds appear in the East

22 May 2020, 12:00am

New video from Tatton Investment Management

18 May 2020, 12:00am

New article from Tatton Investment Management: Us-China cold war: Threat or blessing?

11 May 2020, 12:00am

New article from Tatton Investment Management: Most welcome, if feeble, signs of pulling together

4 May 2020, 12:00am

New article from Tatton Investment Management: Opening-up will be slower than locking down

27 April 2020, 12:00am

New article from Tatton Investment Management: V or U-shaped recovery scenarios - the jury is out

20 April 2020, 12:00am

New article from Tatton Investment Management: Lifting lockdown remains a delicate balancing act

20 April 2020, 12:00am

New video from Tatton Investment Management: Stock markets between hope and despair

15 April 2020, 12:00am

New video from Tatton Investment Management: Is now the time to invest?

13 April 2020, 12:00am

New article from Tatton Investment Management: Fading threat of financial crisis re-opens old divide

6 April 2020, 12:00am

New article from Tatton Investment Management: Unprecedented quarter or calm before the storm?

30 March 2020, 12:00am

New article from Tatton Investment Management: Extraordinary: bear and bull market all in one

24 March 2020, 12:00am

New video from Tatton Investment Management: Why have stock markets appeared to rally on the lock-do

23 March 2020, 12:00am

New article from Tatton Investment Management: Government ordered recession

19 March 2020, 12:00am

New video from Tatton Investment Management: Confusion reigns in Capital Markets

18 March 2020, 12:00am

New article from Tatton Investment Management: Why aren't you doing something?

17 March 2020, 12:00am

New video from Tatton Investment Management: From euphoric recovery to depressed tumble

16 March 2020, 12:00am

New article from Tatton Investment Management: Notes on a crash: the short, the medium and long term

13 March 2020, 12:00am

New video from Tatton Investment Management: Panic equity selling or panic raising of precautionar

12 March 2020, 12:00am

New article from Tatton Investment Management: Forced sellers and other distractions

9 March 2020, 12:00am

New article from Tatton Investment Management: Dark times or glimpse of light at the end of the tunn

6 March 2020, 12:00am

New article from Tatton Investment Management: News of a reverse oil price shock rattles markets bey

2 March 2020, 12:00am

New article from Tatton Investment Management: Coronavirus - hitting too close to home

28 February 2020, 12:00am

New article from Tatton Investment Management: This week's market correction requires perspective

26 February 2020, 12:00am

New article from Tatton Investment Management: COVID-19 and the reaction of markets to pandemic fear

24 February 2020, 12:00am

New article from Tatton Investment Management: US markets hit new all-time highs and a 'bump'

17 February 2020, 12:00am

New article from Tatton Investment Management: V-shaped recovery for Valentine

10 February 2020, 12:00am

New article from Tatton Investment Management: Markets show no fear - should they?

3 February 2020, 12:00am

New article from Tatton Investment Management: Looking through the noise of the week

27 January 2020, 12:00am

New article from Tatton Investment Management: Short break to Goldilocks?

20 January 2020, 12:00am

New article from Tatton Investment Management: Parallels and differences to January 2018

14 January 2020, 12:00am

13 January 2020, 12:00am

New article from Tatton Investment Management: So far so good

8 January 2020, 12:00am

Tatton: Woodford & M&G suspensions have driven IFAs to us

6 January 2020, 12:00am

New article from Tatton Investment Management: 2020 starts with a Trump card

23 December 2019, 12:00am

New article from Tatton Investment Management: Goodbye 2019 - welcome 2020 and a new decade!

16 December 2019, 12:00am

New article from Tatton Investment Management: Brightening horizons - 2020 Outlook

8 December 2019, 12:00am

New article from Tatton Investment Management: Can Trump derail the 2020 economic upturn?

2 December 2019, 12:00am

New article from Tatton Investment Management: Markets are driving the markets

25 November 2019, 12:00am

New article from Tatton Investment Management: Markets pause for reality check

18 November 2019, 12:00am

New article from Tatton Investment Management: Swilling cash eases the market mood music

11 November 2019, 12:00am

New article from Tatton Investment Management: Recession concerns retreat

11 November 2019, 12:00am

Interim Results for the six months ended 30 September 2019

4 November 2019, 12:00am

New article from Tatton Investment Management: Crucial October period safely behind

28 October 2019, 12:00am

New article from Tatton Investment Management: Slowly turning

21 October 2019, 12:00am

New article from Tatton Investment Management: Brexit breakthrough versus Brexit fatigue

17 October 2019, 12:00am

17 October 2019, 12:00am

Acquisition of Sinfonia Asset Management Limited (SAM)

14 October 2019, 12:00am

New article from Tatton Investment Management: Market sentiment rebound

7 October 2019, 12:00am

New article from Tatton Investment Management: Stall speed economy fears spreading

30 September 2019, 12:00am

New article from Tatton Investment Management: Ominous US-Dollar strength

23 September 2019, 12:00am

New article from Tatton Investment Management: Diverging economic trends - catalyst for trade war re

16 September 2019, 12:00am

New article from Tatton Investment Management: Market sentiment rebound

9 September 2019, 12:00am

New article from Tatton Investment Management: Choppy water but no storm, yet...

2 September 2019, 12:00am

New article from Tatton Investment Management: Fattening 'tails'

27 August 2019, 12:00am

New article from Tatton Investment Management: Populism politics reversing austerity?

19 August 2019, 12:00am

New article from Tatton Investment Management: Market spat between bond and equity markets

11 August 2019, 12:00am

New article from Tatton Investment Management: Bond markets unnerve equity markets - again

5 August 2019, 12:00am

New article from Tatton Investment Management: The Elephant and the Little Old Lady

29 July 2019, 12:00am

New article from Tatton Investment Management: The quick and the not-so-quick

22 July 2019, 12:00am

New article from Tatton Investment Management: ...'Twere well it were done quickly

15 July 2019, 12:00am

New article from Tatton Investment Management: Positioning for a summer of wait and see

8 July 2019, 12:00am

New article from Tatton Investment Management: Liquidity drives stock markets to new highs

1 July 2019, 12:00am

New article from Tatton Investment Management: The middle of the year - a tipping point?

24 June 2019, 12:00am

New article from Tatton Investment Management: Battle of the ‘doves’

17 June 2019, 12:00am

New article from Tatton Investment Management: Mixed messages

10 June 2019, 12:00am

New article from Tatton Investment Management: The return of the central bank put?

3 June 2019, 12:00am

3 June 2019, 12:00am

Appointment by Frenkel Topping

3 June 2019, 12:00am

Preliminary Results For the year ended 31 March 2019

3 June 2019, 12:00am

New article from Tatton Investment Management: Bond rally musings

27 May 2019, 12:00am

New article from Tatton Investment Management: It is getting warmer

20 May 2019, 12:00am

New article from Tatton Investment Management: Market support for Trump or unwarranted equanimity?

13 May 2019, 12:00am

New article from Tatton Investment Management: Geopolitics re-enter market stage

7 May 2019, 12:00am

New article from Tatton Investment Management: Central banks disappoint expectations

29 April 2019, 12:00am

New article from Tatton Investment Management: Waning market stimuli put stock markets on notice

23 April 2019, 12:00am

New article from Tatton Investment Management: Spring time from here?

16 April 2019, 12:00am

Trading Statement for 12 months ending 31 March 2019

15 April 2019, 12:00am

New article from Tatton Investment Management: Brexit in-limbo aside sentiment is improving

8 April 2019, 12:00am

New article from Tatton Investment Management: Happy 10th birthday, choppy bull market

1 April 2019, 12:00am

New article from Tatton Investment Management:29 March 2019 – quarter end

25 March 2019, 12:00am

New article from Tatton Investment Management: Brinkmanship and extensions

18 March 2019, 12:00am

New article from Tatton Investment Management: Bits & Pieces

11 March 2019, 12:00am

New article from Tatton Investment Management: ECB stimulus U-turn leaves markets unimpressed

4 March 2019, 12:00am

New article from Tatton Investment Management: £-Sterling ‘applauds’ prospect of Brexit delay

25 February 2019, 12:00am

New article from Tatton Investment Management: Progress?

18 February 2019, 12:00am

New article from Tatton Investment Management: Investment perspectives for different Brexit outcomes

15 November 2018, 12:00am

Interim Results for the six months ended 30 September 2018

15 October 2018, 12:00am

New article from Tatton Investment Management: Autopsy of a stock market sell-off

1 October 2018, 12:00am

New article from Tatton Investment Management: Poor politics containing bond market risks?

27 September 2018, 12:00am

New article from Tatton Investment Management: Brexit clamour vs. real market new

7 September 2018, 12:00am

New article from Tatton Investment Management: Interesting times ahead

31 August 2018, 12:00am

New article from Tatton Investment Management: “Not the end of the worldâ€

24 August 2018, 12:00am

New article from Tatton Investment Management: Steady markets vs. noisy politics

17 August 2018, 12:00am

New article from Tatton Investment Management: Political strongman tactics come home to roost

10 August 2018, 12:00am

New article from Tatton Investment Management: Summer heat wave makes way for return of political he

3 August 2018, 12:00am

New article from Tatton Investment Management: A gentle deceleration?

27 July 2018, 12:00am

New article from Tatton Investment Management: Hot air for a hot summer?

20 July 2018, 12:00am

New article from Tatton Investment Management:Earnings are growing, why worry?

13 July 2018, 12:00am

New article from Tatton Investment Management: Hard Brexit demonstration potential?

6 July 2018, 12:00am

Notice of Annual General Meeting

6 July 2018, 12:00am

New article from Tatton Investment Management: It is getting hot

29 June 2018, 12:00am

New article from Tatton Investment Management: Digesting or consolidating?

27 June 2018, 12:00am

Preliminary Results for the year ended 31 March 2018

22 June 2018, 12:00am

New article from Tatton Investment Management: Fragile recovery

15 June 2018, 12:00am

New article from Tatton Investment Management: No surprises

8 June 2018, 12:00am

New article from Tatton Investment Management: Delicate equilibrium

1 June 2018, 12:00am

New article from Tatton Investment Management: Ignore politics at your peril

25 May 2018, 12:00am

New article from Tatton Investment Management: GDPR? No - far more interesting news!

18 May 2018, 12:00am

New article from Tatton Investment Management: What's the economic reality of this week's news?

11 May 2018, 12:00am

New article from Tatton Investment Management: Batten-down-the-hatches?

4 May 2018, 12:00am

New article from Tatton Investment Management: Past the peak?

27 April 2018, 12:00am

New article from Tatton Investment Management: Confusing signals?

20 April 2018, 12:00am

New article from Tatton Investment Management: A mixture of messages

6 April 2018, 12:00am

New article from Tatton Investment Management: Could do better

6 April 2018, 12:00am

New article from Tatton Investment Management: Peaking, plateauing or dimming – and how about that

29 March 2018, 12:00am

New article from Tatton Investment Management: End of a stormy quarter

23 March 2018, 12:00am

New article from Tatton Investment Management: Now we know it's risky!

16 March 2018, 12:00am

New article from Tatton Investment Management: Back to Normal?

9 March 2018, 12:00am

New article from Tatton Investment Management: Tariffs to growth

2 March 2018, 12:00am

New article from Tatton Investment Management: Time to take some profits

23 February 2018, 12:00am

New article from Tatton Investment Management: Change of direction or gradual normalisation?

16 February 2018, 12:00am

New article from Tatton Investment Management: Breathing easier for the moment

9 February 2018, 12:00am

New article from Tatton Investment Management: Meteoric stock markets crash bac

6 February 2018, 12:00am

Tatton Investment Management's Stock Market Correction Assessment

2 February 2018, 12:00am

New article from Tatton Investment Management: Good news turns bad news - again!

26 January 2018, 12:00am

New article from Tatton Investment Management: Surprises

19 January 2018, 12:00am

New article from Tatton Investment Management: US$ weakness versus Bitcoin and Carillion

12 January 2018, 12:00am

New article from Tatton Investment Management: Bullish sentiment rings alarm bells

5 January 2018, 12:00am

New article from Tatton Investment Management: Encouraging kick-off

15 December 2017, 12:00am

New article from Tatton Investment Management: 2017 - taking stock

8 December 2017, 12:00am

New article from Tatton Investment Management: Progress versus Bitcoin

5 December 2017, 12:00am

Interim results for the six months ended 30 September 2017

1 December 2017, 12:00am

New article from Tatton Investment Management: Sudden, but not entirely unexpected

24 November 2017, 12:00am

New article from Tatton Investment Management: Invincible markets?

17 November 2017, 12:00am

New article from Tatton Investment Management: Yield-curve flattening: a bad omen?

10 November 2017, 12:00am

New article from Tatton Investment Management: Nervous investors herald more volatile markets

3 November 2017, 12:00am

New article from Tatton Investment Management: UK rate rise: ‘one and done’ or beginning of rate

27 October 2017, 12:00am

New article from Tatton Investment Management: Trick or treat season

13 October 2017, 12:00am

New article from Tatton Investment Management: All-time highs and Q3 results outlook: Reasons to be

6 October 2017, 12:00am

New article from Tatton Investment Management: Bad news – good news

29 September 2017, 12:00am

New article from Tatton Investment Management: Movements

22 September 2017, 12:00am

New article from Tatton Investment Management: QT to reverse QE and 2-year transition period to soft

15 September 2017, 12:00am

New article from Tatton Investment Management: BoE guides for year-end rate hike - Bluff or real?

8 September 2017, 12:00am

New article from Tatton Investment Management: ‘Back to school’ amidst hurricanes, earthquakes

1 September 2017, 12:00am

New article from Tatton Investment Management: Bad news, Good news

25 August 2017, 12:00am

New article from Tatton Investment Management: Summer low or summer lull?

18 August 2017, 12:00am

New article from Tatton Investment Management: More sellers than buyers

11 August 2017, 12:00am

New article from Tatton Investment Management: Stocks take note of North Korea crisis - or do they?

4 August 2017, 12:00am

New article from Tatton Investment Management: Consolidated base but momentum dwindling

28 July 2017, 12:00am

New article from Tatton Investment Management: Summer thoughts about the ‘longer term’

21 July 2017, 12:00am

New article from Tatton Investment Management: Summer lull - delayed

14 July 2017, 12:00am

New article from Tatton Investment Management: Pre summer-holiday investment check

7 July 2017, 12:00am

New article from Tatton Investment Management: Global growth ploughs on while markets take a breathe

23 June 2017, 12:00am

New article from Tatton Investment Management: Quo Vadis Britain?